Myths and Legends

My school years were particularly unexceptional, as surfing was my prime focus and an education that included compulsory weekend team sport came a distant second.

Surprisingly, I was introduced (begrudgingly) to the classics by Captain Alastair Courtenay, a very conservative former English soldier turned teacher. I was captivated by the myths and legends. The books that drew me in were The Iliad covering the Trojan War, then The Odyssey by Homer, detailing the adventures of Odysseus from the Trojan wars through the perilous journey back to Ithaca where he uses his wits to escape from Calypso, disfigures the Cyclops and finally leaves the clutches of Circe before returning home to wreak revenge on his wife’s unsavoury suitors.

This brings me to a modern myth and legend: Operating carparks is an easy business; a recipe to print money.

Whilst there are no fantastical creatures in the business, the list of companies that have either failed and disappeared forever or been taken over is as long as Odysseus’s conquests:

- Pacific Parking

- Kings Parking VIC

- Wilson Parking Australia Ltd

- Hooker Parking (no joke!)

- Lend Lease Parking

- Mirvac Parking

- KC ParkSafe

- Premier Parking

- Prestige Parking

- Park Fast

- Choice Parking

- Ezi Park

- Grimes

But such tragedies have not prevented new entrants to the market – either from a startup perspective (such as Point, Nationwide and First Parking) or from large international operators such as Park24 acquiring Secure Parking.

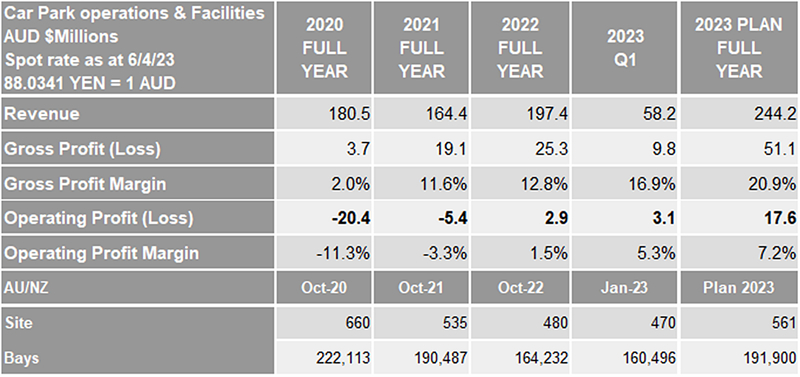

A number of these gallant operators are private companies, exempt from filing detailed financial reports. However, when we look at both Secure and Care, we get a clearer picture of the low returns relative to the risks of leasing carparks – and the very low fees earned from managing them. The following table summarises the position for Secure Parking over the past 3 years and highlights the impact that COVID had on the industry as a whole.

Even if the full year plan for 2023 is realised (including 91 new sites), the margin is only 7.2% – which is exceedingly thin as the economy enters a slowdown that will impact non-essential consumer spending, such as parking.

As of 30 September 2021, the companies total current liabilities exceeded total current assets by $150,693,000.

The company has $70m in loans and borrowings and is fortunate to have a substantial owner in Park24 unconditionally standing behind it, having outlaid approximately $177m for the business in 2016.

The financial statements from Care Park Group Ltd are currently only available for the year ended March 2020. However, they show the impact of COVID from its early stages. Profit for the 2018/19 year was $1.076m on revenue of $123m, turning to a loss of $18.4m on revenue of $143m in 2019/20. The current borrowings were bank loans of $100m and related party loans of $26m. Care own a number of carparks, either parts of strata lots or free-standing, essentially in non-core areas – such as Bendigo. Since lodgement date Care has undertaken a sale process in 2021 for 9 sites. These sites will have come under valuation pressure as a result of interest and cap rate increases, together with revenue challenges from COVID. It will be interesting to see what impact they have had on the balance sheet once up to date returns are available – and how badly COVID impacted the 2020/21 year.

The largest operator, Wilson Parking Australia 1992 Pty Ltd, has released financial statements up to the 30 June 2022 year, which covers the Wilson Group and includes a diversified range of operations including a Security business (about 10,000 employees), Parking, Storage and Patient Transport. The annual reports present a consolidated statement of the Group, so it is not possible to analyse the performance of the Parking division on its own, which was acquired from Wilson Parking Australia Ltd in 1991.

At a Group level, the company made a profit of $1.1m in 2021/22 – a significant improvement on the $11.9m loss in 2020/21, which was impacted by COVID. Group revenue was $911m. It is reasonable to assume the majority of the losses were in the Parking business. The company is in a strong financial position with no bank debt and cash at $74m was slightly up from $70m 2020/21.

The results of all three companies should improve for the 2022/23 year; however, their gross margins will remain subdued and not reflective of the risks associated with leasing and operating carparks.

Given the industries financial exposure to any economic headwinds (such as a recession, COVID) a more diverse business structure containing counter cyclical business units may become more the norm over time.

We have already seen changes in standard lease agreements to protect operators from COVID-type events and more recently the use of non-recourse entities for agreements. Substantial upfront rent-free periods are coming back in vogue (remember the 1990s?) to increase headline rents. And non-binding offers are being put forward that are subsequently withdrawn by some operators when selected as a preferred bidder.

How will operators successfully navigate the years ahead? It will be harder than Odysseus escaping the Sirens – who appear as beautiful as Helen of Troy, but turn into hungry winged birds with vicious claws. Beeswax anyone?