Crisis? What Crisis.

No V shaped recovery for parking.

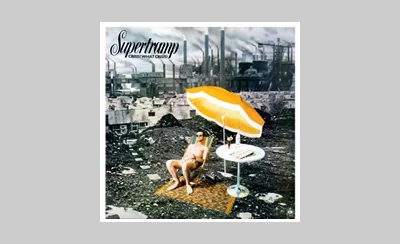

The analogue reader may remember the 1975 Supertramp album, which was rushed out after their 1974 success, Crime of The Century. It was a salient lesson for the band in moving too quickly to capitalise on their new found success. Unreasonable haste is the direct road to error.

The April newsletter had almost 5,000 downloads and created a lot of discussion about the impact of COVID-19 on parking, with a focus on Australia. We are now into the second month of lockdown, the financial pressures are mounting on the operators and there is an impasse on a solution for financial relief between them and owners.

To understand the basis of this, we need to delve into the dark arts of modelling and the assumptions they are based on. The owners are using a “V shaped” recovery to determine the impact and relief package. Operators are looking at some form of L shaped recovery. ParkScience believes it will be somewhat different, which will prove highly problematic for anyone without a strong balance sheet and (in some cases) support from their parent.

I will now set out the two views and provide commentary as to why we are likely to see a new form of recovery in the market.

V Shaped Recovery

This centres around a quick relaxation of the various social distancing and quarantine restrictions we are now seeing with commercial offices and retailers promptly returning to post COVID-19 functionality. Additionally, all day parking volumes and rates will increase (above pre COVID-19 levels) as commuter travel by private vehicle will be seen as safer than public transport. ParkScience agrees with the perception issue and the possibility of volume increases. However this will not be nearly enough to offset the far larger downside forces.

Part of the problem when looking at these generalised concepts is the number of outliers in the market and the fact that you can have two carparks, side by side that have materially different revenues per bay. This is a difficult concept for owners, valuers and consultants to grasp due to a range of factors that are only apparent with micro analysis of the various generators of trade, carpark size, access and competitive forces that are dynamic in nature.

As an example, we will look at night and weekend trade, which is currently down around 90% on pre COVID-19 levels. The generators of this trade include pubs, clubs, restaurants, hotels, entertainment and function/convention centres. All of these will be subject to social distancing restrictions for an extended period – and even when they open it will be gradual and slow. A significant proportion of restaurants will not re open. Most of these depend on travel and tourism. Whilst limited interstate travel will open this year no international travel will appear (except NZ) and when it does in 2021 it is likely to exclude China, USA, Italy and Japan.

As an example, most CBD carparks will have night and weekend trade ranging from 10% to over 25% of their gross revenue. Even a 10% drop will see a carpark lease move to a loss maker.

Even when social distancing rules are relaxed, many parents will not be able to return to work as they now have a new vocation as home teacher. Victoria has taken the toughest stance on school re opening saying it is not safe to return for term 2 – so 13th July is the earliest resumption. NSW is opening on a staggered basis. Parents are all day parkers.

As we saw in the 1991 recession (we had to have) as soon as unemployment starts to rise, there is a corresponding increase in cancellation of monthly parking. The industry has already been swamped with cancellations in the thousands. Some of these will re instate later this year – but with unemployment not expected to peak in excess of 10% until early next year they will be offset by further cancellations. With average bay rates for monthlies in Sydney and Melbourne in excess of $500, revenues will be severely hit.

With remote workplaces comes greatly reduced visitations to offices – so hourly casual parking has also been impacted. And remember the ticket value of ONE hourly casual parker is equal to FOUR all day parkers.

Even when this is resolved there will be a major change in the way corporate Australia works. We have already seen NAB and Telstra announce they will downsize their office bound work force. How comfortable will Directors (and employees) be about workplaces with densities around 1 employee per 10m2? Shutting down bussinesses due to COVID 19 will be easier than re opening them with employers being responsible for safe workplaces that have legal, financial and moral implications.

How will Directors of any company with lease exposures in retail, commercial and hospitality (as well as parking) react to this new and now foreseeable risk? Clauses that provide reasonable tenant protection will become mandatory and non-negotiable.

For carparks relying on student trade – around Chinatown in Sydney and large parts of the southern and western Melbourne precincts – an exceptionally long road to any sort of recovery is inevitable and unlikely to get back to pre COVID-19 levels in the next few years.

And a vaccine is, at best 12 to 18 months away and there is a real chance one will not be found.

Finally, the Federal Government is forecasting a drop of 300,000 people moving to Australia over the next two years. Migration (which has been Sydney and Melbourne centric) has been one of the key factors in Australia avoiding a recession for the past 30 years.

To gain a better understanding of the changes underway in the commercial office market I am grateful to Greg Smith (no relation!) of Heritage Properties for his insightful views provided in A Tenant's Perspective.

A Tenant's Perspective

By Greg Smith

From a tenant’s perspective the office market has finally hit an inflection point that will alter pricing and demand factors.

Over the past two decades supply and rental rates have been artificially and creatively maintained by Fund Managers to prop up pricing and perceived asset value. The payment of performance fees to the entities who sit between the rent payers and the equity owners have driven the imperfect model that has been forced onto the Australian commercial office tenants for the last 20 years. The model has been pushed beyond sustainable levels and COVID 19 is the catalyst for tenants to finally move away supporting the flawed pricing and terms of office leases.

A perfect storm has now converged over both tenants and landlords in the office market sector, many of whom are in survival mode. Tenants are trying to work out how to reduce costs and landlords are desperately trying to maintain rental levels and asset values against a rising tide of rental falls and defaults, which may yet turn out to be a tsunami. That’s certainly the case in the retail sector.

Unlike past crashes this recent economic event has happened universally and with immediacy. The pandemic has effectively put tenants into a disaster recovery mode. Technology has allowed tenant businesses to continue operation on a remote basis. The need to have teams physically separated has highlighted the imperative to manage risk of infection by dispersal of teams away from the traditional centralised office model. This has now become the way of the future. And demand characteristics have changed permanently.

In the short-term tenants driven by cash flow objectives are already trying to offload excess office space onto the sub lease market. Consequently sub lease rental pricing will revert to past market pricing levels which will be about half of the passing headline rent, with fit outs included. In the medium to long term tenants are already evaluating the amount of space required with a view to substantial reductions, its utilisation and how they can mitigate the liability and inflexibility under past leasing models.

With gross rents in Sydney in Melbourne for premium buildings in the $1,200 to $2,000m2 levels, larger tenants can save up to $2,000,000 per annum for each 1,000m2 floor they forego.

Price elasticity of demand has now reached an inflection point for all tenants.

Large tenants will struggle to meet the time and risk lead times associated with pre-leasing developments. Consequently, the constrained supply chain of new office space will no longer force tenants to make such decisions on large tranches of space.

Smaller tenants will seek out more flexible and cost-effective space with less liability of long lease terms.

It may be arguable as to what precisely might occur, but one thing is for sure……. The characteristics of demand have already changed and will continue to, beyond this immediate crisis to ensure the long term sustainability and survival of tenants. Despite the close knit and extraordinary concentration of ownership amongst a handful of institutions , the tight control of supply will no longer be the lever to prop up prices because demand for space has changed .

Decentralisation, multiple offices , hub and spoke models, dispersed team geographies, home working, shared space, third pace working ,variable cost rather than fixed cost models, flexibility and reduced liability ……..will be topics on the agenda for all tenants as we move through this current crisis.

Tenant demand characteristics will change despite any constriction of the supply factor. Many landlords are either in a denialism phase or are simply putting up a brave face. Those experienced players on the landlord side realise that change has happened and is permanent, but they may not admit it.

The pendulum has swung back in favour of tenants, and as leases expire in the coming years their new requirements will result in a demand led fall in rents and ultimately asset values.

The market is already pricing in significant revenue and capitalised value falls with Charter Hall down 51% GPT down 41%, DEXUS down 37% and Scentre Group down 50% on their 52 week ASX high at time of writing.

Clearly the market is not subscribing to a V shaped recovery.

The Stand Off

All the major parking operators in Australia have seen revenue drops in excess of 50% and with net margins on leased sites averaging 5% (at best) are suffering enormous losses that are not sustainable, and will require support from their parent groups to avoid possible failure without either substantial relief from owners and/or a V Shaped recovery in the market.

The V shaped recoevry model, with a few variations being promulgated by owners is for deferral of rents for a period, which need to be repaid and the extension of leases on current terms – either as a new lease or adding extra tenure. This is a Faustian bargain for operators. And no Director will accept lease terms (or rents) based on a pre COVID 19 world.

None of the models comply with the spirit of the National Code of Conduct which, unfortunately is not binding on owners as the large operators are precluded due to turnover. These models may work with a V shaped recovery but will not under any other circumstances.

For regular readers of my newsletter, a constant theme has been the need for both sides to work more closely as it is in all of their best long-term interests. The call could not be stronger now.

In the short-term owners control what relief is offered.

They may win the battle but will lose the valuation war as massive rental reversions will quickly wash through as the WALE on parking leases is very short. Operators learned from the 1991 recession that 10 year leases are too risky, and average terms of between three and five years have been the norm. REITS and private owners will be impacted. The desire of operators to chase market share rather than profits has evaporated. Despite a significant number of terminated monthly or expired leases being offered to the market, not one has been taken up by a competitor at the previous levels – or anything close – and operators are now requiring COVID type clauses for future protection.

And owners of large retail carparks are exposed as there are no leases, so the revenue reductions are immediate.

The final word goes to ANZ CEO Shayne Elliott, who brushed off hopes for a “V shaped recovery” warning of a severe economic downturn, with employment taking three to five years to recover.

So what will the recovery look like for parking revenues? Most likely a staircase with many small increases over an extended period. It took five years for parking revenues to recover from the 1991 recession (we had to have) so there is little chance of the staircase getting back to the first floor before 2025.

The Staircase Recovery will be played out in the coming months and years and will have a profound and long term impact on parking and property in Australia.